I can already anticipate what you are thinking: please, not yet another analysis of new gTLD performance. Believe me, I hear you. But maybe it’s time for a fresh review that doesn’t follow the typical industry analyses in their tendencies toward extreme conclusions like “the hype is over, they failed epically,” or “fantastic, when does the next round start?”. I want to take a sober look at statistics, focusing on OpenSRS’ numbers and what they mean for our resellers.

What makes the OpenSRS numbers different?

While I’m just as addicted to ntldstats.com as anyone in the industry, I believe that OpenSRS can provide an alternative view, one which filters out inflated numbers. Why can I make such a claim? We don’t attract many domain speculators, are not overly active in the Chinese market, and stay away from crazy promotions (like giving away domains for free).

And while there are some special circumstances on our end that have the potential to skew things (OpenSRS owning half the .KIWI and .CLOUD markets, for example), these numbers can easily be normalized where necessary.

More than 13,000 resellers around the world use us for their domains services. Most of them are media agencies, website builders, and traditional web hosters, ranging in size from small SoHos to large multi-million dollar enterprises. Their customers, in turn, represent private end-users, SoHOs, and SMBs. To me, this sounds more like the actual market than the picture we get looking at pure domains-under-management numbers.

So let’s take a look at OpenSRS numbers…

nTLD development vs. other TLDs in Europe and across the globe

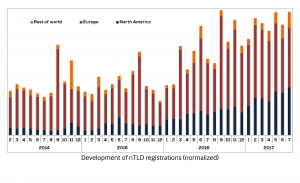

My interest in having a closer look at nTLDs partially stems from working with our resellers in Europe. More than half of all OpenSRS’ nTLD registrations have come from resellers in this region. As glad as I am to see Europe in the lead for something in IT, I’m equally glad to see North America begin to catch up as resellers in the region increasingly attach greater value to the new extensions.

Here’s the current global landscape for nTLD registrations:

In addition to providing a comparison between regions, this chart shows pretty healthy development on a global scale. Note the clear, upward trend in the number of new registrations each year.

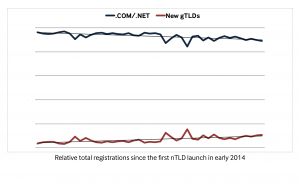

Obviously, this has to do, in part, with the sheer number of nTLDs that have been launched. To be clear, .COM is still king (and .NET, its little prince):

It’s encouraging to see, however, that as a group, nTLDs are seeing strong and steady growth. And though it will likely be a while until this gap closes, if it ever does, the legacy gTLDs are already feeling the heat. Though I’m willing to concede that this evaluation may be unfair, simply because of the incredible number of extensions being grouped into a single “nTLD” category.

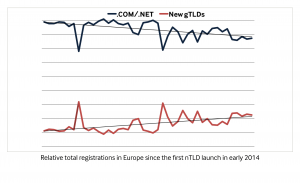

But how about Europe? Just compare the graph below, which displays total relative nTLD registrations in Europe, with the global version we just examined:

As far as the new gTLDs are concerned, Europe gives even more reason for optimism. Keep in mind that ccTLDs, which are traditionally strong in Europe, are not even taken into account in these graphs. But interestingly, they might provide a historical explanation for Europe’s relative openness to a wide variety of TLDs: Europeans have always embraced at least two TLDs, .COM, as well as their local ccTLD.

nTLD top performers at OpenSRS

Let’s return, for a moment, to that first graph on nTLD registration development. If you look closely, you can detect the launches of successful TLDs (e.g. the spike in September 2014 when .LONDON started).

This got me thinking, is there any insight to be gained from a closer look at particularly successfully nTLDs, and their performance over time?

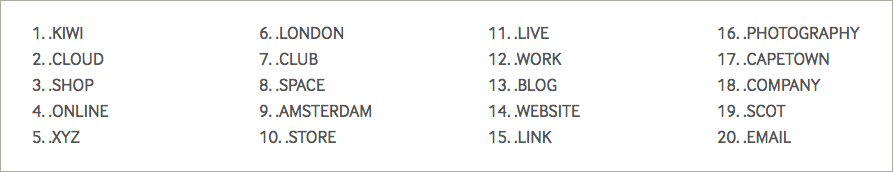

Here are the OpenSRS top 20 nTLDs under management:

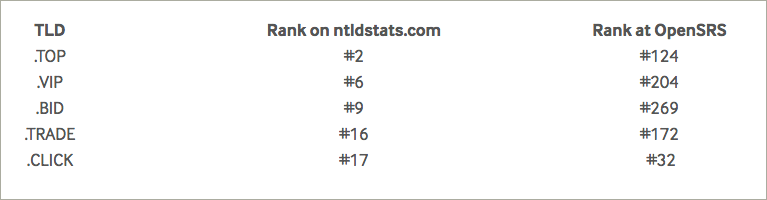

For the record, and as an interesting side note, various TLDs from the ntldstats.com top 20 are missing from our list:

To aid us in our analysis of nTLD top performers, we’ll divide them into what I see as two distinct groups: geoTLDs and non-geo TLDs.

GeoTLDs

A full quarter of the top 20 are geoTLDs (assuming .KIWI is not registered as a fruit name). This makes me particularly happy. Remember when nTLDs were first introduced and the experts made predictions about the overall success of new extensions? Well, I was one of those who put all their money (not literally…) on geos and predicted them to be the stars.

It feels great to be right. But am I?

I looked a bit closer. At the time of their initial introduction, my assumption was that, in any given region, relevant geoTLDs would be as readily embraced as the local ccTLD. For example, if you live in Amsterdam (like I do) and start your own local business (like I did not), you’d be as likely to register your-business.amsterdam as you would its .NL version. This, I concluded, would lead to steadily high registration numbers for geoTLDs.

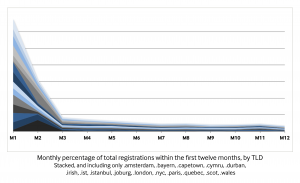

Well, I was certainly wrong here. GeoTLDs seem to launch with a big hooray, and then decline in registrations shortly thereafter, never to recover. This becomes apparent when you look at percentage registration numbers over the first 12 months following launch. (Just to be clear, things do not get better after the 12-month mark):

With a few exceptions, more than half of all domain registrations for these geos occurred within the first two months. Don’t believe it? Go to the ntldstats.com page for .AMSTERDAM or .LONDON and consider what these graphs look like over their entire timeline.

How do the non-geo TLDs measure up?

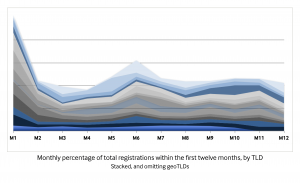

Let’s compare the chart above to the same data for OpenSRS’ top 20 non-geographic TLDs:

Though we once again see a significant spike at the beginning, does this not, overall, look much more balanced? Then again, perhaps I should not be surprised to see a solid performance from our top 20. A steady registration level could simply, in itself, be a sign of a healthy TLD.

One notable shared “feature” across many of these TLDs is a clear and meaningful name. Often, they relate to a specific aspect of the internet or online activity (like .CLOUD, .ONLINE, .SHOP and .STORE). But not always. Take everybody’s darling, .CLUB. And, as if to completely falsify my own argument, I’ll point to the success of .XYZ (which, honestly, I still don’t understand).

Pricing

That phenomenon brings me to an important point: cost.

I won’t get into crazy promotions and their potential to lift registration numbers for the short term. Instead, let’s consider the general price for a domain – does this have a major influence on its registration numbers?

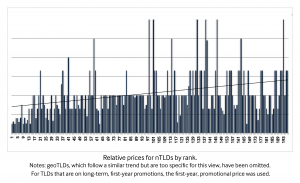

It looks like it does. Here is an overview of the top 200 TLDs at OpenSRS (left to right) with their rough price point on the Y axis:

I want to be clear: we shouldn’t reduce this data to “the cheaper, the better.” There are too many factors at play. The quality of the name is an obvious one, but others, like the positioning order presented to retail customers, and registry marketing efforts (which I might get back to in a separate blog post) also have an impact. What’s certain is that a low-to-mid-range price, in the general area of a .COM, does not hurt the growth of a TLD (I don’t want to write “success” here, as this is clearly a matter of subjective definition).

Conclusions

I want to let some of the numbers speak for themselves and allow you to draw your own conclusions. But I cannot resist offering some suggestions about what this means for our resellers: should you even start (or keep) selling nTLDs?

Well, if you were thinking “no”, I’ve failed. Sure, not everything is shiny in the world of nTLDs. For starters, .COM is still #1 and can be expected to remain so for the foreseeable future.

But at the end of the day, you want to attract and retain hosting customers, right? After all, that’s where the money is! So why not offer a greater selection, and a wiser one, for that matter? Absolutely keep .COM and your local ccTLD as teasers, no question. But give alternative TLDs, and how they could be presented in your customer purchase flow, some thought. Are .ORG/.INFO/.BIZ really still the only logical TLDs to offer, just because they’ve been around forever? Or would a .ONLINE be a more suitable alternative for your customers?

Another point to keep in mind is how great a selection you want to provide. Do you want to offer 100s of TLDs? This can certainly work well, but it necessitates having a stellar domain name suggestion tool within your purchase flow (another topic for a separate post).

So, where should you begin?

Maybe start by curating a smart selection of TLDs. You can begin by taking a good look at general registration numbers (ntldstats.com is a great resource, and hopefully this post is also helping). Next, go a step further by taking into account your specific situation and who you sell to.

Do specific TLDs have a special meaning for your target customer group? If you’re lucky, there’s a popular geoTLD that could strongly appeal to customers in your area (as you can see, I am not giving up on the geos). New TLDs can also help you target niche demographics. For example, do you cater to members of the music industry, many of whom might be intrigued by a .BAND name?

Finally, before adopting a new TLD, consider whether its price is in line with your general offering, and whether you can take advantage of good, long-term, first-year promotions.

Think of these questions as guidelines. I’m sure there are many more to ask, specific to your business. But do give it thought, and don’t miss out on a real opportunity to attract customers and deliver to their needs!

I strongly believe, by the way, that this advice isn’t just applicable to resellers within Europe. As you’ve seen, the North American market, as well as many others, are catching up. Why shouldn’t you ride the wave that the Godaddys and Squarespaces of the world have created?